(Hopefully it was a legit one and not George Costanza’s Human Fund.) Or maybe you had a conversation with your dad about tax write-offs for mortgage interest and your eyes glazed over. To find out more, you can use the IRS’s interactive tool to find out whether your medical expenses are deductible. If you choose the standard deduction, you’ll subtract a predetermined dollar amount from your AGI. And what standard deduction amount applies to you depends on things like your age, filing status and more. If the points are purchased to reduce your interest rate, you can deduct the cost of the discount points. Private mortgage insurance, or PMI, is another expense that many homeowners must factor into their budget.

How does write-off work?

What exactly is a tax deduction? A tax deduction (or “tax write-off”) is an expense that you can deduct from your taxable income. You take the amount of the expense and subtract that from your taxable income. Essentially, tax write-offs allow you to pay a smaller tax bill.

Legitimate tax write-offs can reduce how much you owe and may even help you qualify for a bigger tax refund. Some business expenses may be limited or restricted when it comes to tax write-offs. You should be aware of these types of expenses and refrain from including them in your tax filings. If you travel for work, you can write off a portion of the costs for tax purposes. If you combine both personal and business travel, you must write off only the costs related to business travel.

File

In no circumstances may VAT be deducted in respect of expenditure that is not strictly business expenditure. VAT is deducted by subtracting the deductible amount from the VAT payable in the regular VAT return submitted to the tax authorities. A right to deduct means a taxable person’s right to claim from the tax authorities the VAT paid upon acquired goods and services. If the fees include payments for work of a personal nature (for example, making a will), you can only deduct the part of the fee that’s related to the business. Note that you cannot count the miles driven while commuting between your home and your regular place of business.

Why is a write-off good?

The best benefit from a tax-write off is the reduction of your taxable income, which in turn lowers the taxes you have to pay.

EU country may authorise or require the business to deduct or not to deduct on the basis of the actual use to which all or part of the goods or services are put in respect of a specific transaction. The right to deduct arises when the deductible tax becomes chargeable (Article 167 VAT Directive). Restrictions on deduction apply on certain types of expenditure.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

These deductions are subtracted from your gross income to determine your adjusted gross income, or AGI. If you qualify, you can take them regardless of whether you itemize or take the standard deduction. Your AGI is important because it is the starting point for calculating your tax bill and also the basis on which you might qualify for many deductions and credits. One way the federal government helps taxpayers deal with expenses is by allowing you to reduce the amount of income you pay tax on.

In addition, if your business sells products and uses a third-party payment vendor, like PayPal or Square, you can deduct those fees, too. For 2022, meal deductions were cut back to 50% from the 100% we saw the last couple years. Are you the kind of business owner who likes to wine and dine your clients? Or maybe you like to take your staff out for occasional work lunches at the local watering hole. In addition, you can write off the cost of Wi-Fi that you have to purchase for work purposes, such as while traveling on a plane or staying at a hotel. Whether it was across the state or the country, if you moved your small business, you can recoup some or all of those costs.

– State and local taxes:

And if your business experiences losses for several consecutive years, you won’t get penalized. The IRS will allow you to deduct 100% of your startup expenses, up to $5,000. If you work with freelancers or contractors on a regular basis, remember that you are required to send them a Form 1099-NEC if you pay them discretionary charge at restaurants more than $600 during the tax year. If you get audited and it’s found that you did not provide a Form 1099 to a contractor, you could face a penalty fee. Keep receipts of all your expenses, no matter what you’re deducting. Keeping proof of your expenses will keep you out of trouble if the IRS audits you.

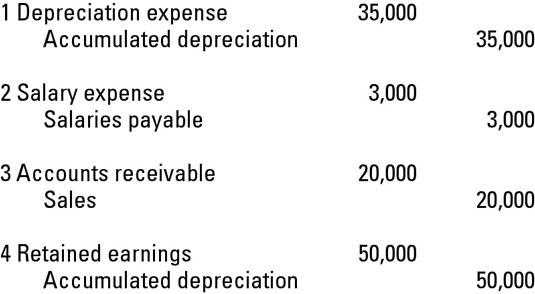

- The rules for depreciation can be complex, but a tax software program will calculate the allowable deduction each year, and allows you to track the write-off in future tax reporting periods.

- Whether it was strictly business, or a combination of business with a few vacation days tacked on, the business expenses of the trip are tax deductible.

- Don’t worry about knowing all these tax rules.You can come to TurboTax and fully hand your taxes over to a TurboTax Live tax expert available in English and Spanish and get your taxes done from start to finish.

- Not every business can claim the same expenses and not every expense can count.

And learning about the rules and limitations of certain tax write-offs can help you decide whether or not to claim them. For example, individual taxpayers can write off several expenses as itemized deductions, including qualified medical and dental expenses, charitable contributions, home mortgage interest and more. Unlike a tax deduction, a tax credit is not the same as a tax write-off.

How much are tax write-offs worth?

While tax deductions lower your taxable income, tax credits cut your taxes dollar for dollar. So, a $1,000 tax credit cuts your final tax bill by exactly $1,000. If you get a $1,000 tax deduction and you’re in the 22% tax bracket, that deduction reduces your taxable income and saves you $220 when it’s all said and done. For example, charitable donations are one of the most common tax deductions. That means you could “write off” the money you gave to charity last year and reduce your taxable income by the amount you gave.

All told, these business expenses reduce your business’s taxable income and therefore decrease the amount of taxes owed in your federal income tax return. To qualify for this deduction, you must be age 66 or older with earned income of at least $20,000 for the taxable year and federal adjusted gross income not in excess of $30,000 for the taxable year. Below-the-line deductions, on the other hand, are qualified expenses that are subtracted from your adjusted gross income to help determine your taxable income. There are dozens of itemized deductions available to taxpayers and all of them have different rules. Examples of itemized deductions include deductions for unreimbursed medical expenses, charitable donations, and mortgage interest.

From retirement plan contributions to home mortgage interest, there are dozens of tax deductions you might be able to take advantage of. It’s important to know what kinds of tax write-offs you do and don’t qualify for. For a business to claim a write-off it must apply these expenses to its revenue. Write-offs do not apply to third-party income or other revenue streams unrelated to the business itself. This comes up most often for individuals who file taxes as a business. You can only take a tax write-off on earnings related to those expenses.

Making tax-deductible donations to Meduza – Meduza

Making tax-deductible donations to Meduza.

Posted: Thu, 22 Jun 2023 13:51:00 GMT [source]

What does it mean to write-off?

wrote off; written off; writing off; writes off. transitive verb. : to eliminate (an asset) from the books : enter as a loss or expense. write off a bad loan. : to regard or concede to be lost.