If you’re using the cash basis, Bookkeeping360 will handle the accruals and deferrals for you. The dedicated bookkeeper will meet you monthly to fix your books and generate monthly reports. If you’re unsure whether Bookkeeper360 is the right assisted bookkeeping service for you, check out our guide on the best online bookkeeping services for more choices.

With a CFO, you can optimize your business, minimize costs, and maximize profits through effective planning, organizing, and monitoring. Bookkeeper360, founded in 2012, is a financial technology firm that offers accounting and cloud-based bookkeeping and business advisory services. As a Xero Platinum partner, Bookkeeper360 provides seamless integration with Xero’s cloud-based accounting software. Collective offers financial solutions for self-employed business owners. It provides financial solutions such as bookkeeping, tax management, accounting, payroll management, and more. If you’re using Xero or QuickBooks, both the desktop and mobile apps will connect to your account and provide information like scorecards and metrics.

Like Bookkeeper360, Bookeeper.com is a U.S.-based online bookkeeping service provider that works with small businesses. Bench offers its services in five plans, designed to accommodate businesses of different sizes based on their monthly expenses. Regardless of your plan, Bench connects you with a dedicated bookkeeper with whom you work to set up all of your information and accounts on the Bench platform. Bookkeeper360 is an online bookkeeping service designed to help small and medium-sized businesses with their bookkeeping and accounting. When you sign up for Bookkeeper360, you receive a dedicated account manager, who will work with you to create a service strategy that meets your needs.

The three CFO Advisory plans are called “Advisory,” “Coaching” and “Inventory.” The Advisory plan includes services such as KPI reporting, profitability improvements and basic operational processes. The Coaching plan is more in-depth, not only providing assistance with overall systems and operations but also strategic planning and executive coaching. Finally, the Inventory plan is designed on a project basis and can accommodate inventory management, workflow planning, inventory projections and reorder points. Bookkeeper360 offers a range of support options for businesses in conjunction with its core bookkeeping services. The CFO will help in determining and evaluating key performance indicators, performing profitability analysis, developing a growth strategy, and optimizing cash flow.

For instance, we see consistent labor costs throughout the year except in July. Moreover, costs arising from Scooby Snacks can be a mixed cost because it has fixed and variable components. You can interpret this chart in many different ways, and it can aid you in decision-making. The new Bookkeeper360 Marketplace is a place where you can connect third-party apps that can integrate with Bookkeeper360 services. Take note that not all third-party integrations offer special discounts and offers. Bookkeeping.com is a great Bookkeeper360 alternative if you already use QuickBooks and prefer pricing based on transactions.

Bookkeeper360 Alternatives

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution. Finaloop provides accounting software specifically tailored to ecommerce companies. Perhaps one of the most helpful ways to judge a provider is by reading its customer reviews. One of the notable benefits of Bookkeeper360 is that almost all of its reviews online are extremely positive. Additionally, Bookkeeper360 offers custom app integrations based on specific project and business needs.

If you use a solution like Freshbooks or Wave and want to keep that software, you’ll have to search for another bookkeeping service. Aside from tax, the Bookkeeper360 team will work with you to analyze your financials and determine a strategy to manage and grow your business through the CFO advisory program. This separate service includes capital management and business coaching.

If you need help, you can contact them via phone or live chat and set up unlimited meetings. They will also grant you access to their screen so that you can view your books. This website is using a security service to protect itself from online attacks. Bookkeeper360 There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. That means you’ll spend less time acting as a go-between and have more time to focus on growing your business.

Professional Services

If you want a more detailed view of business performance, you can switch to the Metrics view to year-over-year data for revenue and common size amounts for gross profit, net income, and payroll. You can also check your working capital and debt-to-equity ratio to measure your business’s short-term and overall liquidity. Excluded in the bookkeeping service would be customer invoicing, inventory management, and vendor billing because these fall under a separate product called Back-office services.

- Other custom integrations are priced per project, and you have to work with the Bookkeeper360 team directly to determine this cost.

- You can use this year-over-year comparison to spot seasonality in revenues and expenses.

- Our team-based approach ensures that you get the knowledge and expertise you need on your accounting team.

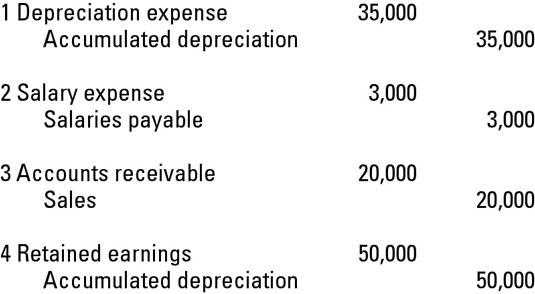

On the whole, Bookkeeper360 is a good solution for startup and growing companies. Under cash-basis accounting, revenues and expenses are recorded when cash is paid or received. Meanwhile, accrual accounting records revenue and expenses when earned or incurred. Learn more in our cash- vs accrual-basis accounting method comparison, which also covers when to use each.

Check out what our customers are saying

This revenue source is not present in all months while merchandise licensing is consistent in almost all months. As a business owner, you can use this chart to analyze revenue not just as a whole but in different components. You can also reach out to your dedicated adviser through the Tasks section, which eliminates the need to email your bookkeeper if you have questions. You can create a task for your bookkeeper, set a due date, and wait for them to get back to you. This feature is available because the communication happens within the Bookkeeper360 interface. Their application that provides great visuals of how our business is doing on a daily basis with goals and metrics.

Bookkeeping is the core service that Bookkeeper360 offers and is available by signing up for a consultation with its U.S.-based team. Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years.

- Bookkeeper360 is an accounting solution designed to help businesses view financial data, streamline bookkeeping operations, and track goals on a unified platform.

- It shows that revenue sometimes increases, decreases, peaks, or plummets.

- And so, I don’t have to spend the time that we were spending in-house to deal with all of these bookkeeping issues.

- Although Bench does not provide tax services, it can work directly with your CPA during tax time or connect you to a tax professional in its network.

- The direct cost column chart above is another chart that you’ll find very useful in costing.

Bookkeeper360’s service does not require a contract, and you can cancel at any time. For cash-basis accounting, pricing starts at $399 per month for companies with up to $20,000 in monthly expenses. For accrual-basis accounting, prices start at $549 per month for companies with up to $20,000 in monthly expenses.

Bookkeeping

The features you receive with Bookkeeper360 will largely depend on what your business needs and what kind of strategy you develop in your consultation. Ultimately you can choose services that range from advisory support to full, hands-on bookkeeping management. Digits develops application programming interfaces (API) for businesses and finance professionals. It uses classification algorithms, and machine learning techniques to provide a real-time view of a business’s finances. The company was founded in 2018 and is based in San Francisco, California.

Technology

Bookkeeper360 provides a sliding scale tool on its website for this cost. If you have more than 30 employees, you have to contact them directly to determine the cost of its payroll services. Bookkeeper360 is working on its own application, 360app, that will allow you to manage all of your Bookkeeper360 services, from accounting to financial planning, in one place. This app has not yet launched, but according to the Bookkeeper360 website, will be included in all packages.

The Best Overall Bookkeeping Solution for Small Businesses

“Bookkeeper360 provided a window into my business that I never knew I needed.”